Décortiquer le marché du travail à Tours : opportunités et conseils pour optimiser sa recherche

La ville de Tours, avec son dynamisme économique et sa qualité de vie reconnue, attire de nombreux professionnels chaque année.…

Pourquoi contacter une agence web spécialisée en e-commerce pour votre projet ?

Le commerce en ligne a connu un essor fulgurant ces dernières années. Les entrepreneurs dans ce secteur se multiplient et…

Les dangers d’un entretien négligé: Comment éviter les réparations coûteuses

Les Risques d’Ignorer l’Entretien de Votre Voiture L’entretien régulier de votre voiture est essentiel pour assurer son bon fonctionnement et…

Comment grossir ses levres naturellement ?

Disposer de lèvres pulpeuses est le souhait de bon nombre de femmes aspirant à être les plus séduisantes qui soient. Dans…

Quelle moyenne pour passer en classe de seconde générale ?

La classe de 3e représente la dernière année de collège et marque la fin de ce cycle d’apprentissage approfondi. C’est…

Avis sur culotte de règle : un choix confortable et écologique pour les femmes

L’engouement pour les alternatives durables dans les produits d’hygiène féminine a mené à l’émergence de solutions innovantes, parmi lesquelles la culotte de règles. Ce sous-vêtement révolutionnaire, conçu pour absorber le…

Petite salle de bain 3m2 : aménagement et optimisation de l’espace

Dans l’univers de l’habitat, l’aménagement d’une petite salle de bain représente un défi majeur pour les propriétaires et les locataires.…

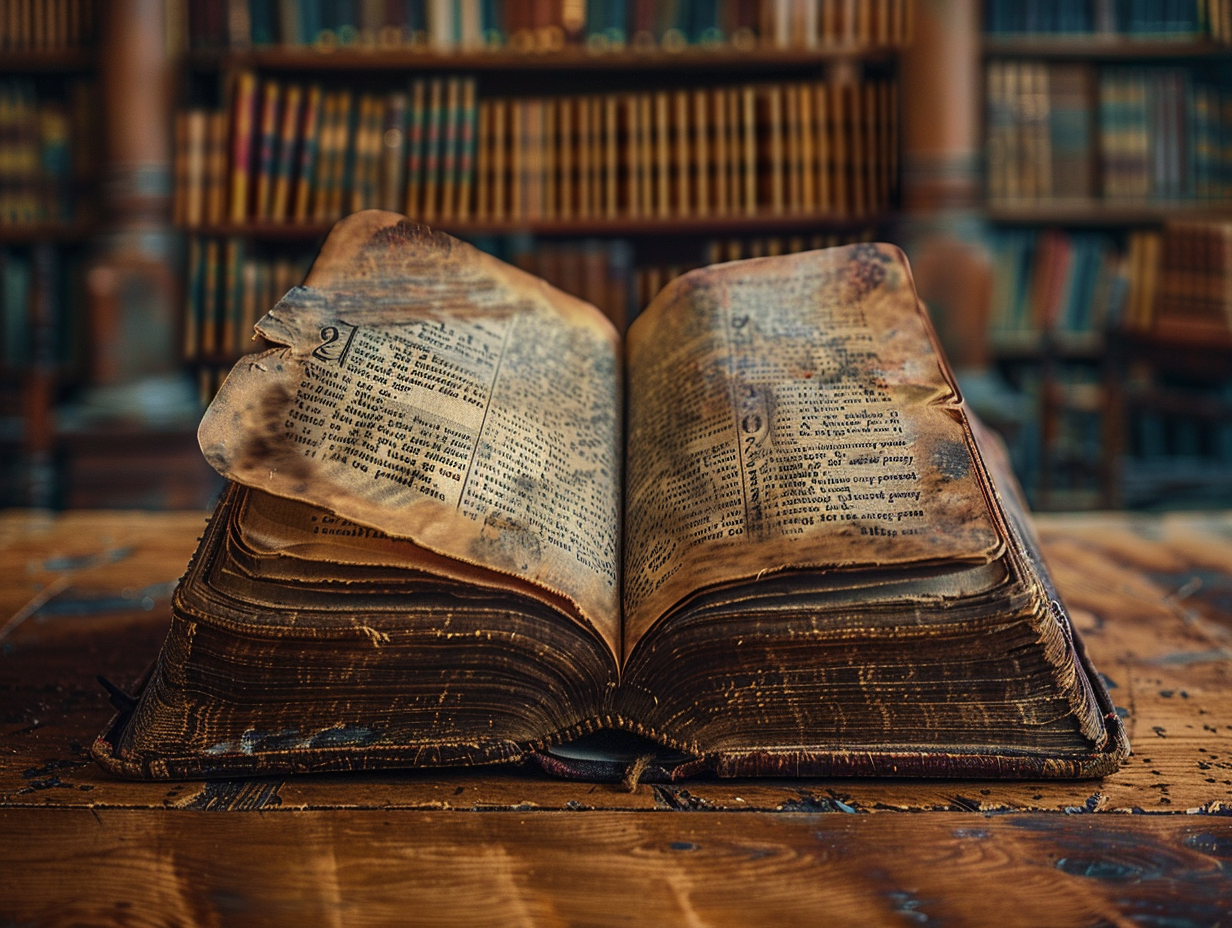

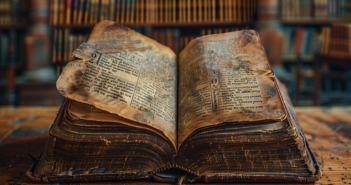

Citations célèbres erronées : démêlez le vrai du faux en citations

Les citations célèbres sous le microscope : vérités et contrevérités Les citations traversent les époques, souvent érigées en vérités incontestables.…

Que dire à propos du contrôle électrique d’INGERIS ?

Pour démontrer la conformité de vos installations électriques, vous devez effectuer un contrôle. Évidemment, il s’agit du contrôle électrique. Plusieurs…

Qu’est-ce que activités des sociétés holding ?

Pour la création d’une société, il est important que vous optiez pour une forme de société adapté à votre activité.…

Cartes Snapchat : problème, bug et panne

Snapchat est l’une des applications de messagerie les plus téléchargées au monde. Si elle est autant appréciée par ses utilisateurs, c’est en raison des multiples fonctionnalités pratiques dont elle est…